|

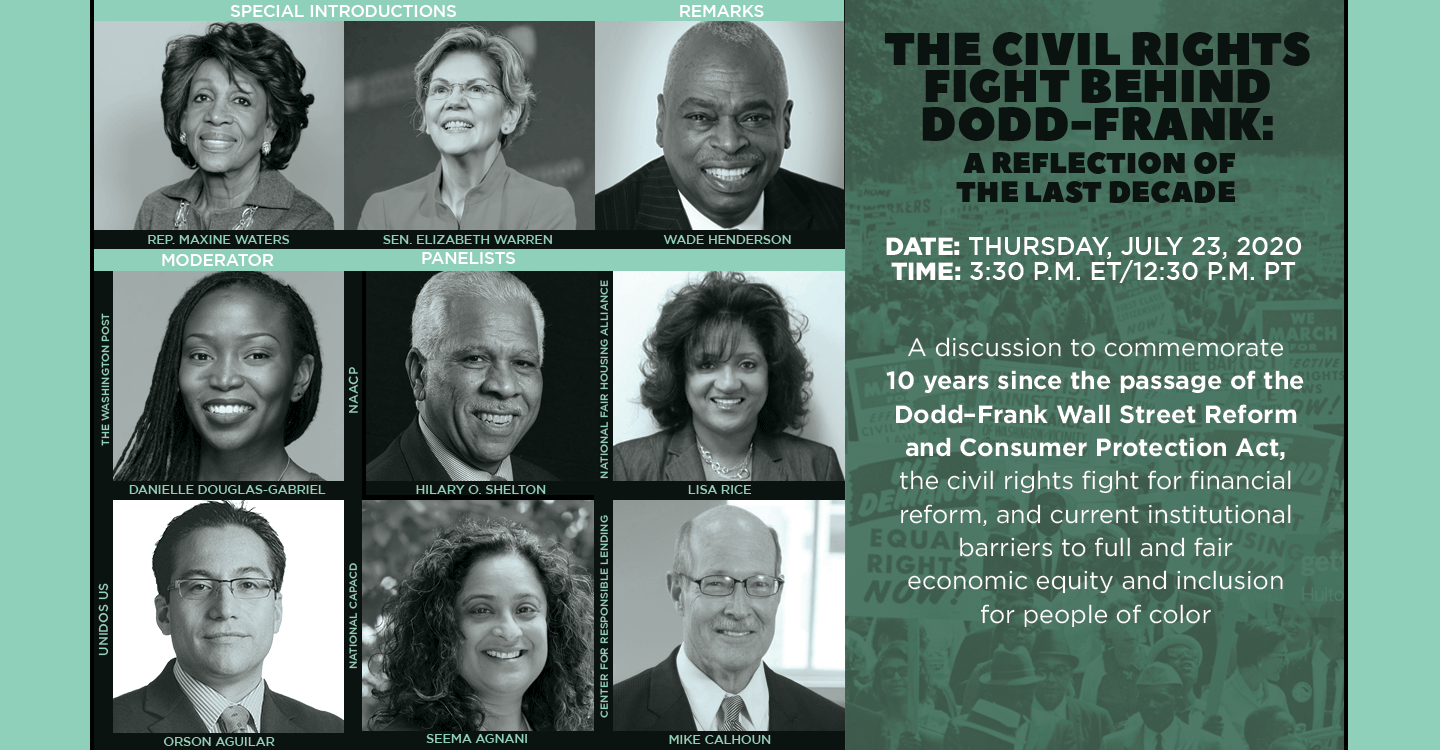

On Thursday, July 23, at 3:30 p.m. ET/ 12:30 p.m. PT, the Center for Responsible Lending (CRL) will host a virtual panel discussion to commemorate 10 years since the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which established the Consumer Financial Protection Bureau (CFPB).

The talk will focus on the civil rights groups' push for the financial reform law, a reflection on the CFPB's work, and hopes for the future. The discussion will also touch on Dodd-Frank''s impact on communities of color and on current institutional barriers to full and fair economic equity and inclusion, especially during this COVID-19 economic and public health crisis.

Panelists will include leaders from CRL, NAACP, National CAPACD, National Fair Housing Alliance, and UnidosUS, with special introductory remarks from Congresswoman Maxine Waters and U.S. Senator Elizabeth Warren, and closing remarks from civil rights leader Wade Henderson.

You can watch the live stream on CRL''s Facebook page: https://www.facebook.com/CenterforResponsibleLending/

If you have a question that you would like the panelists to address, please let us know: https://forms.gle/nuTkt1B2FFrCAARS7.

Please share this with anyone who may be interested: retweet CRL and share the Facebook Event.

|